Too Good To Be True - Protecting Yourself and Vulnerable Loved Ones From Scams

Welcome to Saving Money with Andrew!

Last week, a fascinating Ask MetaFilter thread caught my eye. It was about these ubiquitous signs you may have seen before. Just a couple months ago, I saw at least 20 of them posted on telephone poles in my area:

This appears to be a common scam, and this Reddit thread tells one unsuspecting victim’s story.

We’re bombarded with things that seem too good to be true every day. Poorly-written spam emails, “forced auctions” of fine art, or crypto “savings” accounts promising 15%+ returns. And while there’s no prize for successfully avoiding them, it only takes falling for one scam to inflict permanent damage on your finances.

You may have realized the sign above was a scam. But maybe you didn’t! I always looked at these signs with curiosity, having spent a fun summer 20 years ago buying and reselling items from liquidation auctions and garage sales.[1] On the face of it, this seemed like just another variation of something legitimate.

And even if you never fall for something like this, you likely have family members, particularly older ones, who are susceptible to scams. The elderly are particularly prone to scams and cash solicitations, fraudulent or not, and trouble with money or uncharacteristic generosity are common signs of age-related mental decline. And people who didn’t grow up with the Internet often have trouble distinguishing legitimate emails and websites from phishing scams.

What can you do if you have vulnerable relatives?

Use good security and privacy practices, and help relatives set them up

If you’re reading this, I’m sure you’ve set up two-factor authentication for all of your sensitive accounts (Gmail, financial accounts, etc). But you almost certainly have relatives who don’t, and it’s worth bringing it up to them and helping them set it up, starting with Google’s security checkup.

Having 2FA set up can often mean the difference between a catastrophic case of identity theft (if a relative enters their password in response to a phishing link) and a fairly easily fixable mistake (if 2FA is set up to make it more difficult for a compromised password to allow access to critical accounts).

Don’t make money and estate planning a taboo subject

Families have a wide range of attitudes about money. My family is typically pretty open about it, but in many families it’s a treacherous subject. Money discussions can often cause bitterness and envy, and can be awkward to have.

But, if you have parents in late middle age or older, it’s worth asking them the simple question of what you should do if anything ever happened to them. They may have set aside instructions of what to do in case they are incapacitated (or worse), and if they took the time to prepare those, they would want you to know where they are. Those instructions might include where to find account passwords, financial records, and other important documents. At the very least, if they have Gmail they should set up Google’s Inactive Account Manager, which after a certain period of time of inactivity will provide account access to a few trusted contacts.

And if they haven’t, try gently recommending they consider speaking to an attorney about basic estate planning, health care planning, and any other necessary items. If money is an issue, it’s fairly common for public libraries or senior centers to offer free sessions about basic estate planning. Just make sure the presenter is an actual volunteer, and not just trying to drum up business.

Keep close watch to the extent you can

Finally, if you help older loved ones with day-to-day activities, make sure to keep an eye on their finances to make sure something doesn’t seem off. Things to watch out for include a sudden uptick in generosity, particularly mail solicitations from charities or political candidates, or any new financial accounts. It is *extremely* common for older individuals to think charitable appeals are being made directly to them (or to think they are bills), and to write checks for all of them.

And now, Andrew’s pick(s) of the week:

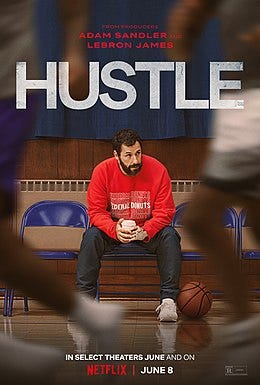

Hustle is about as conventional and formulaic as sports movies get, but it’s fun, well-acted (despite more than half of the characters played by current and former NBA players) and worth watching. Adam Sandler’s “serious” movie career has been a revelation. Punch-Drunk Love (2002) and Uncut Gems (2019) are both terrific.

I hope this has been helpful. If you liked it, please share it on social media! Also, please send me your feedback, requests, and success stories.

[1] Was it lucrative? Not really, but a few great finds included an Atari 2600 in its original box, a 19th-century Currier & Ives print, and a lot of old but resellable computer equipment.